Insulet Corporation (NASDAQ: PODD) is a prominent medical device company specializing in innovative insulin delivery systems, notably the Omnipod® Insulin Management System. Founded in 2000, Insulet has significantly impacted diabetes care by offering tubeless, wearable insulin pumps that enhance patient convenience and compliance.

Business Model and Product Offering

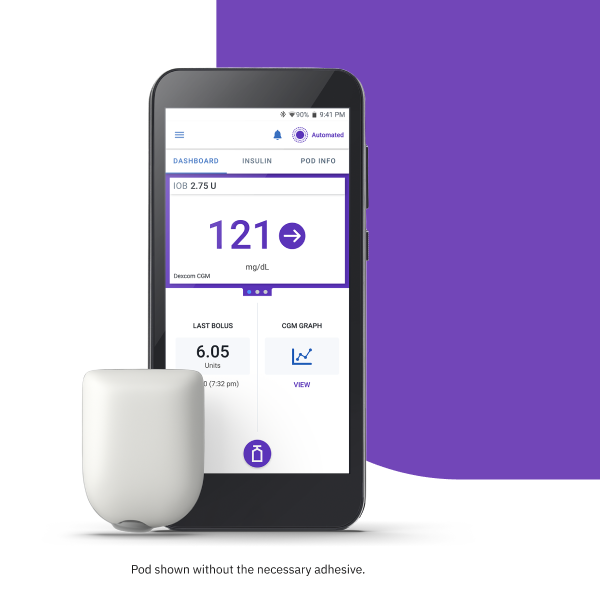

Insulet’s primary revenue driver is the Omnipod® system, a tubeless, wearable insulin pump that provides continuous insulin delivery for individuals with diabetes. The company’s business model focuses on product innovation, user-friendly design, and expanding global reach. By investing heavily in research and development, Insulet aims to meet the evolving needs of diabetes patients worldwide.

Financial Performance

In the third quarter of 2024, Insulet reported robust financial results:

- Revenue: $543.9 million, a 25.7% increase from the same period in 2023. Insulet Investors

- Gross Margin: 69.3%, up 150 basis points from the prior year.

- Operating Income: $88.1 million, representing 16.2% of revenue, an improvement from 12.7% in the prior year.

- Net Income: $77.5 million, or $1.08 per diluted share, compared to $0.74 per diluted share in the prior year.

These results reflect strong demand for the Omnipod® system and successful international expansion.

Market Position and Growth Prospects

Insulet holds a competitive position in the insulin delivery market, with key competitors including Medtronic, Tandem Diabetes Care, and Eli Lilly. The recent FDA clearance of Omnipod® 5 for type 2 diabetes expands Insulet’s addressable market, potentially increasing its user base significantly.

Recent Developments

- International Expansion: Insulet has launched Omnipod® 5 in multiple international markets, contributing to a 35% organic growth in international revenue in Q3 2024. Business Insider Markets

- Product Innovation: The company continues to enhance its product offerings, focusing on extending product wear times and integrating advanced technologies to improve user experience.

Stock Performance

Insulet’s stock has shown significant movement recently, reaching new 52-week highs following analyst upgrades. For instance, JPMorgan Chase & Co. raised their price target to $330.00, reflecting confidence in Insulet’s growth prospects.

Conclusion

Insulet Corporation demonstrates strong financial performance, strategic market expansion, and continuous product innovation, reinforcing its position as a leader in the insulin delivery market. The company’s focus on addressing both type 1 and type 2 diabetes, along with its international growth, positions it well for sustained success in the evolving healthcare landscape.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Please consult with a financial advisor before making any investment decisions.

Market Expansion Potential

The addressable market for Omnipod® 5 among type 2 diabetes patients is highly significant due to the increasing prevalence of diabetes globally. According to recent statistics:

- Growing Patient Population: The International Diabetes Federation estimates that the global number of adults with diabetes will rise to 783 million by 2045, with type 2 diabetes accounting for approximately 90% of cases. This creates a massive potential customer base for innovative insulin delivery systems like Omnipod® 5.

- Market Penetration Potential: Many type 2 diabetes patients currently use multiple daily injections (MDI) to manage their condition. Omnipod® 5 offers a more convenient, automated alternative, appealing to patients seeking to simplify and improve their glucose management.

- Economic and Lifestyle Benefits: As awareness grows about the cost savings and lifestyle improvements offered by advanced insulin delivery systems, more patients and healthcare providers may transition to products like Omnipod® 5.

- Revenue Impact: Insulet’s recent FDA clearance for Omnipod® 5 in type 2 diabetes significantly expands its target market. The company projects substantial growth as it captures market share within this demographic. Analysts predict that this expansion could lead to double-digit revenue growth over the next five years, potentially outpacing market expectations.

- Geographic Growth Opportunity: As Insulet expands internationally, particularly in regions with rising diabetes rates (e.g., Asia-Pacific and the Middle East), the addressable market grows even further.

Conclusion: If Insulet can effectively penetrate the type 2 diabetes market, leveraging its innovative technology and strategic pricing, it stands to unlock a substantial new revenue stream, driving sustained growth for years to come.

Competitive Landscape

Insulet Corporation has a multi-faceted strategy to sustain its competitive advantage against established players like Medtronic and Tandem Diabetes Care. Here’s how it plans to achieve this:

1. Product Differentiation

- Tubeless Technology: Unlike many competitors, Insulet’s Omnipod® system is tubeless, offering greater convenience, discretion, and comfort for users. This design continues to resonate strongly with patients seeking hassle-free insulin delivery systems.

- Ease of Use: Omnipod® 5’s automated insulin adjustments and integration with continuous glucose monitors (CGMs) simplify diabetes management, making it particularly attractive to first-time pump users and those looking to transition from multiple daily injections.

- Expansion into Type 2 Diabetes: By tailoring Omnipod® 5 for type 2 diabetes patients, Insulet has opened a new market segment, differentiating itself from competitors who focus predominantly on type 1 diabetes.

2. Innovation and R&D Investment

- Continuous Improvement: Insulet invests heavily in research and development to introduce features like extended wear times, enhanced connectivity, and greater integration with digital health platforms.

- Technological Ecosystem: Collaboration with CGM leaders like Dexcom and Abbott ensures Omnipod® systems remain cutting-edge in glucose monitoring technology.

- Pipeline Products: Insulet is reportedly working on next-generation Omnipod® products that may further enhance usability and expand indications, solidifying its innovation-driven competitive edge.

3. Pricing Strategy

- Flexible Pricing Models: Insulet’s pay-as-you-go pricing model appeals to cost-conscious patients, eliminating upfront costs associated with traditional insulin pumps. This is particularly advantageous in markets with less favorable reimbursement structures.

- Cost Savings for Healthcare Systems: By reducing hypoglycemia and other complications through automated insulin delivery, Omnipod® potentially decreases long-term healthcare costs, enhancing its appeal to providers and payers.

4. Market Reach and Partnerships

- International Expansion: Insulet is aggressively entering new markets, leveraging regional partnerships and tailoring its approach to local healthcare systems to outpace competitors like Medtronic in underserved regions.

- Strong Physician and Patient Advocacy: The company actively engages with healthcare providers and patient communities to build trust and drive adoption, strengthening its market position.

5. Focus on Customer Experience

- User-Centric Design: Insulet places a strong emphasis on designing products that simplify diabetes management and improve quality of life.

- Comprehensive Support: Insulet provides robust customer support and educational resources to enhance the user experience and ensure successful adoption of its technology.

Conclusion

Insulet’s focus on differentiation through tubeless technology, continuous innovation, strategic pricing, and market expansion positions it well to compete with Medtronic, Tandem Diabetes Care, and others. By addressing patient needs more effectively and maintaining its innovation pipeline, Insulet is poised to sustain and grow its competitive advantage in the insulin delivery market.

International Growth Strategy

Insulet’s international growth strategy is a key driver of its expanding revenue base, with several regions offering significant potential for growth. However, there are also challenges associated with global expansion. Here’s a detailed analysis:

Regions Poised for Growth

- Asia-Pacific

- Market Potential: This region has one of the highest growth rates of diabetes prevalence globally, particularly in countries like China and India. Increasing healthcare spending and improving access to advanced medical technologies make it a prime target.

- Growth Drivers:

- Expanding middle-class population with better healthcare awareness.

- Government initiatives to improve diabetes care infrastructure.

- Opportunities:

- Partnering with local distributors to navigate market dynamics.

- Leveraging educational campaigns to boost adoption of insulin delivery systems.

- Europe

- Market Potential: Countries like Germany, the UK, and France have robust healthcare systems with widespread reimbursement coverage, making them attractive markets.

- Growth Drivers:

- Favorable reimbursement policies for diabetes management technologies.

- A growing preference for tubeless and automated insulin delivery solutions.

- Opportunities:

- Increasing adoption among pediatric and adolescent diabetes patients.

- Collaborating with national health services to integrate the Omnipod® system into standard care protocols.

- Middle East and Africa

- Market Potential: Rising diabetes rates and growing awareness of advanced treatment options present a substantial opportunity.

- Growth Drivers:

- Urbanization and lifestyle changes contributing to a diabetes surge.

- Efforts to modernize healthcare systems and provide better treatment options.

- Opportunities:

- Introducing affordable pricing models to cater to diverse income groups.

- Collaborating with local healthcare providers to ensure access.

- Latin America

- Market Potential: Countries like Brazil and Mexico have large diabetic populations, but insulin pump penetration remains low.

- Growth Drivers:

- Increasing healthcare investments by governments and private players.

- Rising demand for innovative diabetes solutions.

- Opportunities:

- Establishing a strong presence through regional partnerships and distribution networks.

- Educating healthcare professionals and patients on the benefits of automated insulin delivery.

Challenges in Expanding Further

- Regulatory Barriers

- Navigating diverse regulatory frameworks in new markets can delay product launches and increase compliance costs.

- Approval timelines and varying safety standards may require additional investment in clinical trials and documentation.

- Reimbursement and Affordability

- Limited or fragmented insurance coverage in some regions may restrict patient access.

- Affordability issues in developing markets could necessitate creative pricing strategies.

- Cultural and Market Adaptation

- Differences in healthcare practices and patient preferences require tailored marketing and educational efforts.

- Resistance to new technologies or established reliance on traditional insulin management methods could slow adoption.

- Supply Chain and Distribution

- Ensuring reliable distribution networks in remote or underserved areas presents logistical challenges.

- Political and economic instability in certain regions may disrupt supply chains.

- Competition

- Established local players or other global competitors may already have a foothold in certain markets, making it harder for Insulet to penetrate effectively.

Conclusion

Insulet’s international growth strategy is well-positioned to leverage opportunities in high-potential regions like Asia-Pacific and Europe while addressing challenges through localized approaches, strategic partnerships, and innovative pricing models. If the company continues to execute its strategy effectively, international markets could become a significant driver of its long-term growth.

Technological Advancements

Insulet Corporation is committed to advancing insulin delivery technology to enhance patient experience and drive customer adoption and retention. Below are key areas of innovation and their potential impact:

Innovations in Insulin Delivery Technology

- Tubeless Insulin Delivery

- Current Advantage: The Omnipod® system is already differentiated by its tubeless design, offering patients greater convenience and mobility compared to traditional insulin pumps with tubing.

- Future Enhancements:

- Smaller, more discreet pods to improve wearability and comfort.

- Extended pod wear times (beyond the current 3-day cycle) to reduce the frequency of changes and enhance convenience.

- Omnipod® 5 Automated Insulin Delivery (AID) System

- Integration with CGMs: Omnipod® 5 integrates seamlessly with Continuous Glucose Monitors (CGMs) like Dexcom G6, enabling real-time glucose monitoring and automated insulin adjustments.

- Adaptive Algorithms: Advanced algorithms allow for personalized insulin delivery that adapts to a patient’s unique glucose patterns, improving glucose control and reducing the risk of hypoglycemia.

- Broader Indications: Recent FDA approval for type 2 diabetes expands the system’s usability, addressing a larger patient population.

- Smartphone Compatibility

- Mobile App Integration: Insulet has introduced app-based controls, allowing users to monitor and manage their insulin delivery directly from their smartphones.

- Remote Monitoring: Caregivers can access real-time data, enabling better support for pediatric and elderly patients.

- Future Developments: Expanding compatibility with more devices and operating systems to make the technology accessible to a broader audience.

- Advanced Data Analytics

- Insights for Better Management: Insulet is leveraging data analytics to provide users with actionable insights into their glucose patterns, helping them make informed decisions about their health.

- Cloud-Based Platforms: Integration with cloud platforms allows data sharing with healthcare providers for personalized treatment plans.

- Closed-Loop Systems

- Insulet is working towards a fully closed-loop system where the Omnipod® can automatically deliver basal and bolus insulin without manual intervention, creating a more autonomous experience for users.

- Eco-Friendly Pods

- The company is exploring sustainable materials for pods to align with environmental concerns and attract environmentally conscious consumers.

Impact on Customer Adoption and Retention Rates

- Improved Convenience and Quality of Life

- Innovations such as tubeless design, smartphone compatibility, and extended wear time reduce the burden of diabetes management, attracting new users and retaining existing ones.

- Enhanced Clinical Outcomes

- Automated insulin adjustments and adaptive algorithms improve glycemic control, leading to better clinical outcomes. Satisfied patients are more likely to continue using the system.

- Broader Patient Base

- Innovations like Omnipod® 5 for type 2 diabetes and closed-loop systems appeal to a wider range of patients, increasing adoption rates.

- Increased Engagement

- Features such as real-time monitoring, data sharing, and actionable insights foster deeper patient engagement, improving adherence and loyalty.

- Competitive Differentiation

- By staying ahead of competitors in terms of innovation, Insulet strengthens its market position, making it a preferred choice among patients and healthcare providers.

Conclusion

Insulet’s focus on advancing insulin delivery technology—through tubeless systems, automated features, mobile integration, and eco-friendly initiatives—positions it as a leader in the diabetes management market. These innovations are expected to drive higher customer adoption and retention rates, solidifying Insulet’s growth trajectory in the coming years.

Financial Outlook

Insulet Corporation’s improved financial performance, reflected in higher gross margins and operating income, provides a solid foundation for strategic capital allocation to sustain growth and profitability. Here’s how Insulet is likely to prioritize its capital deployment:

Strategic Priorities for Capital Allocation

- Research and Development (R&D)

- Focus: Continued investment in R&D is essential to maintain Insulet’s competitive edge in insulin delivery innovation.

- Goals:

- Enhance the Omnipod® platform with new features, such as extended wear times and fully closed-loop systems.

- Develop next-generation products to address broader diabetes needs, including type 2 diabetes and other metabolic disorders.

- Expected Impact: Sustained innovation will drive adoption, expand the addressable market, and reinforce brand loyalty.

- Market Expansion

- International Growth: Allocate resources to penetrate high-growth regions, such as Asia-Pacific, the Middle East, and Latin America.

- Build localized partnerships to streamline market entry and distribution.

- Tailor marketing strategies to regional healthcare practices and reimbursement policies.

- Domestic Expansion: Strengthen market presence in the U.S. by increasing adoption in underpenetrated demographics like type 2 diabetes patients.

- Expected Impact: Increased global footprint and diversified revenue streams.

- International Growth: Allocate resources to penetrate high-growth regions, such as Asia-Pacific, the Middle East, and Latin America.

- Manufacturing and Operational Efficiency

- Automation and Scalability: Invest in advanced manufacturing technologies to increase production efficiency and reduce costs.

- Vertical Integration: Explore opportunities to bring more of the supply chain in-house, minimizing reliance on third-party suppliers.

- Expected Impact: Improved gross margins and operational resilience against supply chain disruptions.

- Customer Experience and Support

- Educational Initiatives: Allocate resources to educate patients and healthcare providers about the benefits of Omnipod® systems, particularly in new markets.

- Support Services: Expand customer support infrastructure to ensure a seamless experience for users, enhancing satisfaction and retention.

- Expected Impact: Strengthened customer relationships and higher retention rates.

- Strategic Partnerships and Mergers & Acquisitions (M&A)

- Collaborations: Partner with CGM providers like Dexcom and Abbott to enhance product integration and compatibility.

- M&A: Explore acquisitions of complementary technologies or companies to diversify product offerings and accelerate innovation.

- Expected Impact: Strengthened market position and accelerated entry into adjacent markets.

- Shareholder Returns

- Balanced Approach: While prioritizing growth investments, consider share buybacks or dividends to reward shareholders, particularly as free cash flow increases.

- Expected Impact: Maintain investor confidence and support stock performance.

- Debt Management

- Leverage Reduction: Use improved cash flow to reduce debt levels, optimizing the company’s capital structure.

- Expected Impact: Enhanced financial stability and flexibility for future investments.

Balancing Growth and Profitability

Insulet’s ability to allocate capital efficiently across R&D, market expansion, and operational efficiency ensures its growth trajectory while maintaining healthy profit margins. Strategic investments in customer engagement and technology partnerships will further solidify its competitive edge, while a balanced approach to shareholder returns and debt management ensures long-term financial sustainability.

Conclusion

By aligning its capital allocation priorities with growth opportunities and operational efficiency, Insulet is well-positioned to sustain its profitability and capture market share in the evolving diabetes care landscape. This strategic focus will likely drive continued financial success and investor confidence.

PODD Stock Price